Incorporating a company doesn’t always have to be done in your home country. Offshore companies can offer many benefits that businesses wouldn’t otherwise get, including greater privacy and better tax rates.

Ironically, an Andorran “offshore company” technically exists in a landlocked country. It doesn’t get much more “onshore” than Andorra!

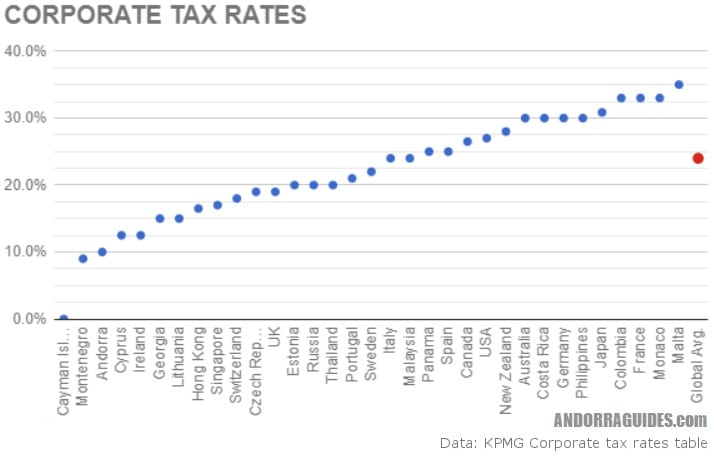

Despite this irony, an Andorran company remains appealing to many entrepreneurs, thanks to the country’s very low corporate taxes.

Companies formed in Andorra are taxed at a maximum rate of 10%, while a comparable company in the USA, a country known to compete for international business, will have to pay 21% in corporate taxes.

In this article, we will run you through the basics of what you need to know about Andorran companies.

Benefits of Incorporating in Andorra

The shares of a trading enterprise or non-trading holding company can be 100% owned by foreigners, which prevents the need for partnering with local investors. This saves time as the business can be formed even faster.

Since there is no stock exchange in Andorra though, shares are bought and sold through the Public Notary via private treaty.

When you form an Andorra offshore company, only one director is mandated and can be a shareholder.

Unlike popular offshore locations to incorporate such as Hong Kong or Singapore, the names of both directors and shareholders are private and can not simply accessed via an online portal, giving your company increased privacy. Though no longer considered a true tax haven, privacy is a core value of the banking and business sector in Andorra.

Requirements for Andorran Companies

Before your company is formed, you’ll need to decide which type of company is right for you. There are two main types:

- Societat Limitada: For smaller businesses with €3,000 of share capital.

- Societat Anònima: For multi shareholder companies with a minimum capital of €60,000.

The name of the company can not resemble another legally registered business within Andorra, or infringe on a local trademark. While the name used to have to be in Catalan, it is now 100% fine to register a company in English or other languages that use Latin characters.

When choosing a name, usually the lawyer or agent helping you will ask for 3 or so variations to make sure they can find one that is available for you.

Owning a company in Andorra won’t entitle you instantly to work or trade. First you will have to obtain a trading license and tax number. Then you may live and work locally as a director within your company after acquiring residency in Andorra.

Annual meetings between all of the shareholders is a mandatory practice.

Taxes

All companies registered in Andorra are subject to local taxes.

The standard corporate tax rate is 10%, however there are exists a lowered tax regime for software development, licensing and intellectual property companies that are resident in Andorra, where they pay 2%. This is however, rumoured to change.

Resident directors and shareholders don’t have any other tax liability, presuming they take dividends after corporation tax has been paid thanks to the lack of double taxation in Andorra.

Non-resident shareholders should know there is a 10% tax on any income made in Andorra by a non-resident.

For more details on taxation, take a look at our article on the Andorran tax system.

How to Register a Company

The first step in creating an offshore Andorra company is to apply to the government. You will be required to present documentation including:

- An apostilled police background report

- Your birth certificate

- A proposed business plan with financial forecasts

- A copy of your passport

Do note any certificates will need to be within 3 months of issue.

If the application is approved, you, along with any other shareholders, are obliged to be present during the formation of the company. This is completed at a notary office within Andorra and the official deed will be issued afterwards. It is recommended to have a lawyer or local expert write the statutes beforehand to avoid any legal complications.

On average, the entire process of forming a company will take four weeks.

From 2003 to 2013, the service sector generated almost 88% of the countries GDP. If your company offers services, you’ll find no shortage of potential customers.

There is also the option of purchasing an existing Andorran company. The statutes will ideally match your interests because an application needs to be made to change them, otherwise.

Accounting Requirements

After forming a company within Andorra, the government may request annual accounting reports. This is to ensure that taxes are being correctly paid, the business is developing and staying compliant.

Monthly, quarterly, and mid-year reports on payrolls may also be obligation if you employ local staff.

Your company will also have to remain compliant by paying CASS, part of the social security and healthcare system.

Offshore Companies in Andorra

For entrepreneurs interested in creating an offshore company, it would be wise to consider Andorra. Though the country is rarely considered the best place to start a company, it can be particularly interesting for the right type of business.

You will keep 100% ownership, have the privilege of low corporate taxes, and retain your privacy.

No limits on shareholders and the one director rule also makes forming a company relatively low effort.

Better yet, for individuals looking to establish low-tax residency, incorporating in Andorra opens a door to both active and passive residency programs.

If you have more questions on offshore companies in Andorra, don’t hesitate to contact us!

Feature image: TUBS, Andorra in Europe, adapted by Andorra Guides, CC BY-SA 4.0