Company Formation

Avoid costly hassles by ensuring you choose the right entity and classification. Getting set up correctly the first time doesn’t only save money, it can save a lot of time too.

Your Guide to Company Formation in Andorra

Andorra is a popular business environment for entrepreneurs who want to start their own company. In-a-nutshell, incorporating a company in Andorra brings you the many of benefits of doing business in Europe without the high taxes.

Getting Set Up Correctly

Andorra’s small size doesn’t mean that fewer rules apply for company formation. In fact, they may be very different from what you’re used to. It’s important to have a plan before you set out to incorporate an Andorran company.

The government requires companies to register detailed articles of association that spell out how a company will conduct business.

Getting it right the first time around is best, as it can be somewhat time-consuming and costly to change these after the fact.

For this same reason, buying an existing ‘shelf company’ is not a viable workaround for the company formation exercise.

Types of Andorran Companies

As in other countries, there are different entities to choose from when when starting a company in Andorra.

It’s important to choose the most appropriate entity. Options vary depending on how much liability the owners want to bear and the size of the company. The government allows the following registration types:

Societat Limitada (S.L.)

This is the formation to choose for most small businesses and is the equivalent of an Andorran limited liability company. A Societat Limitada needs to have €3,000 of capital at its time of formation.

Societat Limitada Unipersonal (S.L.U.)

Essentially a Societat Limitada with only a single shareholder (hence the ‘unipersonal’). Similarly, an S.L.U. needs to have €3,000 of capital at its time of formation.

Societat Anonima (S.A.)

Enterprises that require a larger number of shareholders and increased anonymity will want to choose this entity. An S.A. requires a minimum of €60,000 in capital at it’s time of formation.

Pricing

The total cost to register an Andorran company can be a moving target with some service providers, in some cases based on an hourly rate.

At Andorra Guides, we believe in certainty and transparency. Our pricing is fixed, so it won’t increase during through the process. Guaranteed!

- Visit for 1 notary meeting, we take care of the rest

- No revenue limitations inside or outside of Andorra

- Includes opening of a local trade

- Choose from an S.L. or S.L.U.

- Every step translated to English

- Includes opening a bank account

- Employ as many people as you need

- Allowed to pay yourself a salary

- Visit for 1 notary meeting, we take care of the rest

- Operational base must be in Andorra

- 85%+ of revenue must come from outside of Andorra

- Choose from an S.L. or S.L.U.

- Every step translated to English

- Includes opening a bank account

- Only 1 employee allowed

- No salary, only dividends at the end of the year

More services

Of course, if you need further assistance, we won’t leave you in the dark.

Once your company is established we’ll not only introduce you to our trusted contacts to keep your company in good order, we’re happy to help with other matters too.

Collection of Mail

€85+ per month

Other Matters

€49

Change of Company Purpose

€499

An expert who has your back

Moving to, and doing business in a new country can be a steep learning curve. You really need someone on your side to help make the transition as smooth as possible.

Guy’s combined experience in property management and helping new residents move to Andorra has placed him in a unique position to help newcomers. He not only has the knowledge to help you make the right decisions, he can connect you with the right people at the right time as well.

The Process of Registering a Company in Andorra

The steps below outline everything that we’ll take care of on your behalf.

When working with us, we minimise your visits to Andorra. Once we have prepared all the correct documents, we can handle the rest remotely.

Step 1

Foreign Investment Application

Though pro-business, there are controls on funding your future company in Andorra. Before registering a company, you need to fund a business bank account. Before that is possible, you’ll need to have government approval to make that investment. You’ll need to provide certified passport and criminal record checks in this step, as well as the source of funds.

Step 2

Registering Your Company Name

Early on in the process, you’ll want to secure the name of your new corporate entity. Historically this needed to be in Catalan, but nowadays this has been relaxed. There are some tricks to finding the right name, but we’ll guide you in shortlisting your options, so we can secure one for you.

Step 3

Opening a Business Bank Account

Different businesses have a unique banking needs. You also need to find the bank that understands your business model. Even within that bank, you’ll then need the right contact to get your account opened. We’ll help you to connect with that contact.

Step 4

Acquiring a Bank Certificate Showing Funded Capital

Each company requires paid-in capital—the cash amount given for in exchange for shares. For most entities, the minimum amount of €3,000 is used, though this amount can vary. Whatever the amount, you’ll need proof by way of a bank certificate to show that this is paid-in to the company’s bank account.

Step 5

Sign the Company Deeds With the Notary

Your company needs legal documentation defining what it does, who owns it, and how it can be operated. This must be signed, in-person at a notary. Signing generally takes no more than an hour, but getting an appointment can take months. We have some regular times booked in to help you save a lot of time here.

Step 6

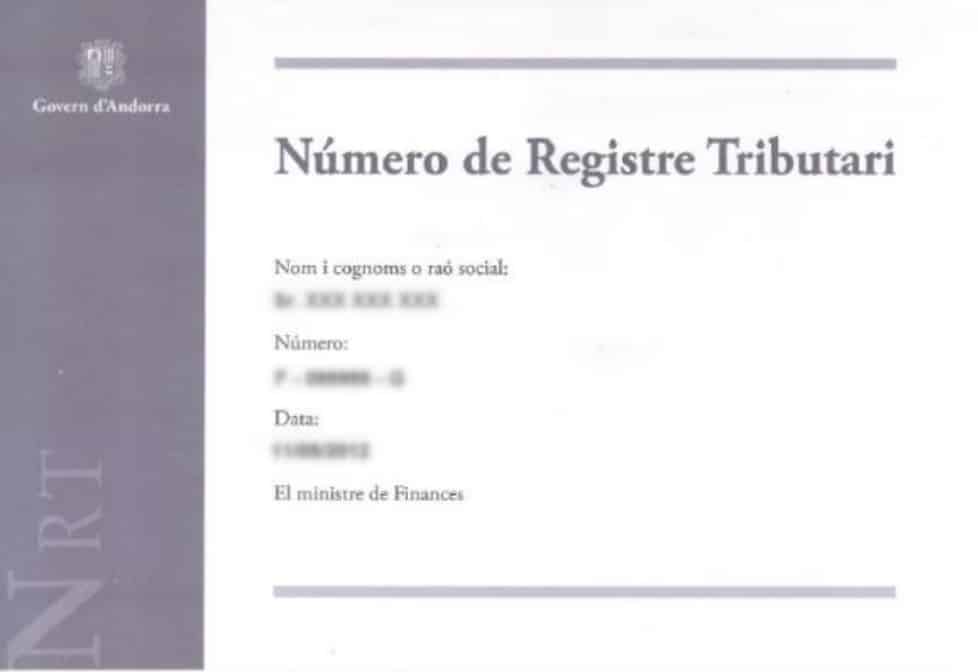

Applying for the Company’s Tax Identification Number

In order to trade and pay taxes in Andorra, your company requires a Número de Registre Tributari, or tax identification number. Acquiring one is straightforward, via the Department of Taxes and Borders. If you’re working with us, we’ll handle this for you, but if not, know that an appointment is required.

Step 7

Beneficial Owners Declaration

Thankfully a simple step, where shareholders and Ultimate Beneficial Owners of your societat need to be declared. We will fill this paper form and deliver it to the appropriate government office for you.

Step 8

Finding Your Office Space and Arranging Certificates

Each trade registration requires an official office space in order to register with the local parish. For most residents, this is their home, though it’s important to be aware that only one company can be registered per address. For this reason, if you’re renting, it’s important to confirm that this is possible before signing your lease.

Step 9

Register Your Business With Your Town Hall

In order to be allowed to invoice, your business needs to be registered with your parish. This is where business activity, trade name certification, office floor plan, fire extinguisher contract and rental or purchase contracts will be declared, as well as paying the fees. There’s a lot to process here, and we handle it all for our clients.

Step 10 (Active only)

Register for CASS

For companies owned by active residents or employing local residents, payments will need to be paid into Andorra’s combined social security and healthcare system, CASS. This involves registering both the company, and any individuals employed, both of which are included in our service.

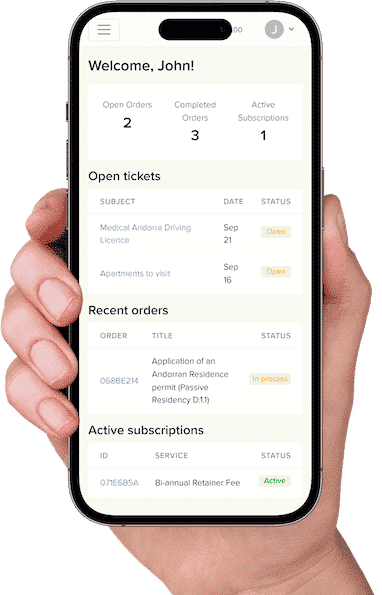

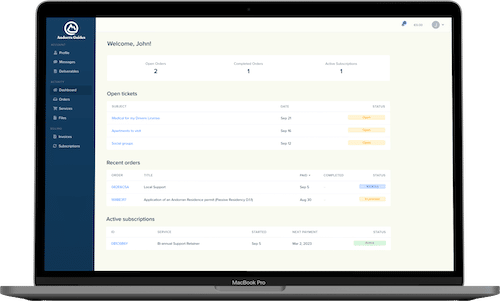

Everything you need in one place

Without someone taking care of the details, your move to Andorra can be met with unnecessary delays.

Simply fill in our forms and upload any documents.

We’ll take care of the rest, keeping a record of all files and communication in our secure dashboard, where you can find everything you need, at any time.

Everything you need in one place

Without someone taking care of the details, your move to Andorra can be met with unnecessary delays.

Simply fill in our forms and upload any documents.

We’ll take care of the rest, keeping a record of all files and communication in our secure dashboard, where you can find everything you need, at any time.

Q&A

What’s the yearly cost of running a company?

Once your company is set up, there are some annual operating expenses. These sum up to approximately €1,200 per year for government and local government fees, at least €1,200 per year for an English speaking accountant and company tax filing, and €533.87 per month for social security (CASS) of each resident shareholder.

Is it possible to register an ‘offshore’ company in Andorra?

As of October 2012, it has been legal for an Andorran company to be owned (in whole or part) by a non-resident. If the non-resident owners have a total stake greater than 10% of the company there will be an extra layer of government approval needed. Those non-residents wanting to form a new company in Andorra must acquire foreign investment approval first.

I have clients outside of Andorra (in UK, USA and Italy, for example). Do I need to collect IGI (VAT/sales tax) on these services?

No, in this case IGI (Impost General Indirecte) does not apply. An Andorran company that invoices clients based outside of Andorra is a ‘prestació de serveis’ not subject to IGI. They just need to add the reason on their invoices. I.e. the reason the operation is not subject to IGI.

Which payment processors are available for my company to take credit card payments?

At this time, the range of payment processors aren’t as large as you might expect from larger countries. Most banks offer Redsys, which is a very low cost option, but there are other alternatives available.

Is a holding company required to rent office space?

A holding company is not required to have an office address.

Can your firm manage the ongoing accounting needs of my company?

We refer clients to our trusted accounting partner. You aren’t obliged to use their services, but if you choose to do so, you can take advantage of our pre-negotiated preferential rates.

Already here and want us to handle the daily hassles?

Not yet in Andorra, but want to make the move?