Take the hassle out of getting set up in Andorra, so you can get started living the good life.

Let our experts save you time, money and stress by guiding you through opening bank accounts, applying for residency, forming companies and more.

Trusted by residents from all walks of life

You make the move, we’ll handle the details

Residency Application

Get guidance with finding the right residency program for your needs. Then take advantage of our experience to make the process as smooth and as fast as possible.

Company Formation

Avoid costly hassles by ensuring you choose the right entity and classification. Getting set up correctly the first time doesn’t only save money, it can save a lot of time too.

Local Support

There’s more to the move than applications and paperwork. We’ll help you find somewhere to live, the right school for your kids, a trusted tradesperson, or even collect your post. You can focus on making Andorra home.

Everything you need in one place

Without someone taking care of the details, your move to Andorra can be met with unnecessary delays.

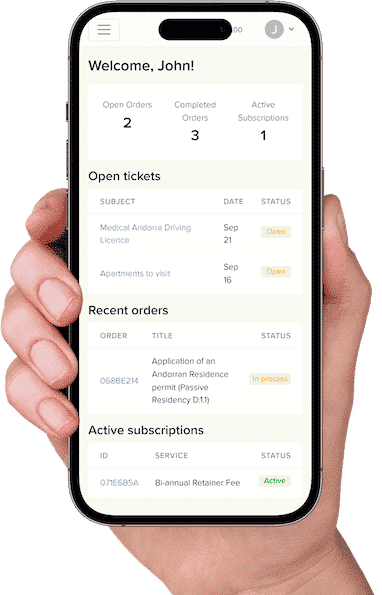

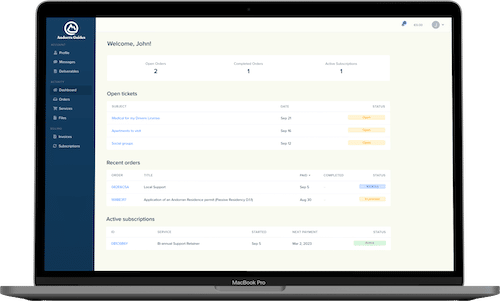

Simply fill in our forms and upload any documents.

We’ll take care of the rest, keeping a record of all files and communication in our secure dashboard, where you can find everything you need, at any time.

Everything you need in one place

Without someone taking care of the details, your move to Andorra can be met with unnecessary delays.

Simply fill in our forms and upload any documents.

We’ll take care of the rest, keeping a record of all files and communication in our secure dashboard, where you can find everything you need, at any time.

An expert who has your back

Moving to, and doing business in a new country can be a steep learning curve. You really need someone on your side to help make the transition as smooth as possible.

Guy’s combined experience in property management and helping new residents move to Andorra has placed him in a unique position to help newcomers. He not only has the knowledge to help you make the right decisions, he can connect you with the right people at the right time as well.

Latest posts

Bitcoin & Cryptocurrencies in Andorra

While cryptocurrencies, DAOs, DeFi, and other blockchain related projects develop at a rapid rate, most governments are struggling to keep up. Combined with the extremely risk adverse attitudes of many banks around the world, bridging the gap between traditional finance,…

Andorra Real Estate Rentals: Listings & Prices

Moving to a new country can be stressful and confusing. You must manage legal permits, schedule transportation, account for language and cultural differences, and find accommodation. This last point is crucial. You won’t be truly settled in your new country…

What It Is Like to Live in Andorra

If you’ve seen photos of the beautiful scenery or have read about Andorra’s tax, healthcare and school systems, it’s easy to fall in love with our tiny country. But, understandably you’re cautious. Exactly what is it like living in Andorra?…

Already here and want us to handle the daily hassles?

Not yet in Andorra, but want to make the move?