Even after recent changes to its tax system and hard work to shed its image as a tax haven, Andorra remains an attractive jurisdiction for those who want to start a company.

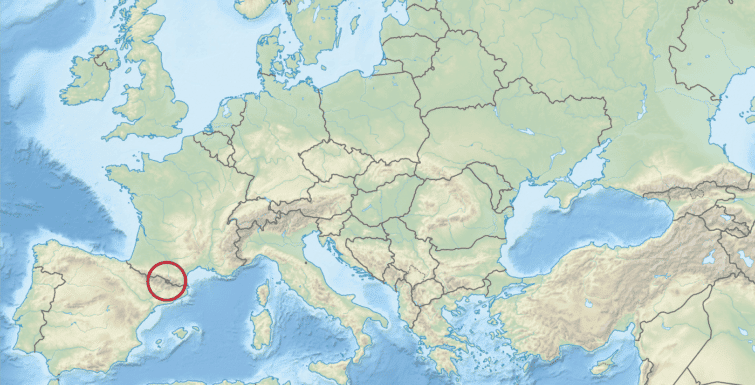

Andorra’s 10% (maximum) corporate tax rate and respect for privacy mean that many entrepreneurs turn here when they are looking to incorporate a ‘mid-shore’ company. After all, the country is completely landlocked!

If that’s something you’re interested in doing, you’ll probably find our guide to offshore companies in Andorra useful.

Many people who move to Andorra end up starting their own company. This is popular enough that there are even two options for Andorran residency permits that involve starting a company. This makes it debatably one of the best countries for entrepreneurs to call home.

If this is part of your plan, you’ll want to check out our comprehensive package for company formation in Andorra. We handle everything from sole proprietorships to corporations with many shareholders.

Keep in mind that the Andorran government is relatively hands-on throughout the process to start a company here. If doing business locally, that means you’ll have to be able to operate in Catalan — or hire someone to help.

Andorra is a pro-business environment with a fair tax system and a reasonable amount of regulation. It’s a great place to start a business that will thrive for many years.