Hidden in the Pyrenees mountains is the low-tax Principality of Andorra.

Andorra offers endless opportunities for both residents and tourists alike. However many of these people would have never found Andorra on the map without its low, but fair tax system.

In this article we’ll review Andorra’s tax rates, the different types of tax and the laws associated with the Andorran tax system for both individuals and companies.

Resident Personal Income Tax

Andorra’s income tax for resident individuals is known as IRPF, or “Impost sobre la renda de les persones físiques”.

What Is the Personal Income Tax Rate in Andorra?

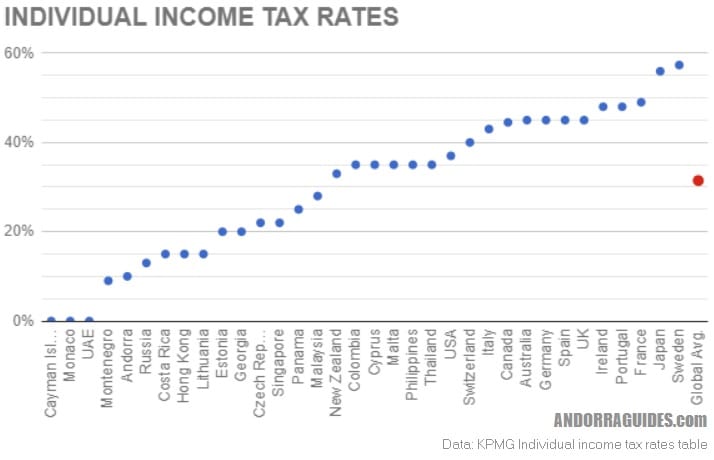

The nominal personal income tax rate in Andorra is 10%. That is, the maximum an individual will pay is 10%.

Similar to many countries however, Andorra uses a bracket approach to its personal income tax system.

Income Tax Brackets for Individuals

- €0 – €24,000: 0%

- €24,001 – €40,000: 5%

- €40,001+: 10%

Income Tax Brackets for Married Couples

- €0 – €40,000: 0%

- €40,001+: 10%

Who Is Liable for IRPF?

IRPF applies to any individuals with Andorran tax residency, that is;

- someone who resides in Andorra for more than 183 days in a year, or

- someone who keeps the majority of their business, economic and life activities in Andorra, commonly referred to as a “permanent place of abode” by some countries.

What Type of Income Is Taxable?

Andorran income tax applies to all forms of income, capital gains and losses. Unlike many countries with a territorial taxation system, Andorra taxes its residents on their worldwide income.

Taxable income includes:

- salary from an overseas employer,

- dividends or coupons from investments held abroad,

- pension, superannuation, savings or insurance plans from abroad.

Are Any Types of Income Exempt?

Though limited, some forms of income are exempt from tax. In most of these cases, the investments need to be made within Andorra.

Exempt types of income include:

- income from Andorran government bonds,

- dividends and other income from holdings in entities registered in Andorra,

- dividends and other income from holdings in entities resident in Andorra,

- capital gains and losses,

- income from funds deposited with an Andorran bank, up to €3,000,

- public grants and scholarships,

- literary, artistic or scientific prizes.

For more information, see Article 5 – “Exempt Income” of Law 5/2014.

Non-Resident Income Tax

Tax on income for non-resident individuals and entities is known as IRNR, or “Impost sobre la renda dels no-residents fiscals”.

IRNR is payable when an non-resident individual or entity earns income from economic activities in Andorra.

IRNR, the Andorran income tax on non-resident individuals and entities is 10%.

Corporate Tax in Andorra

Any company incorporated in Andorra, or resident in Andorra (due to a registered office or having effective management in the country) is considered a tax resident in Andorra.

Entities resident in Andorra are taxed under IS, or “Impost de societats”.

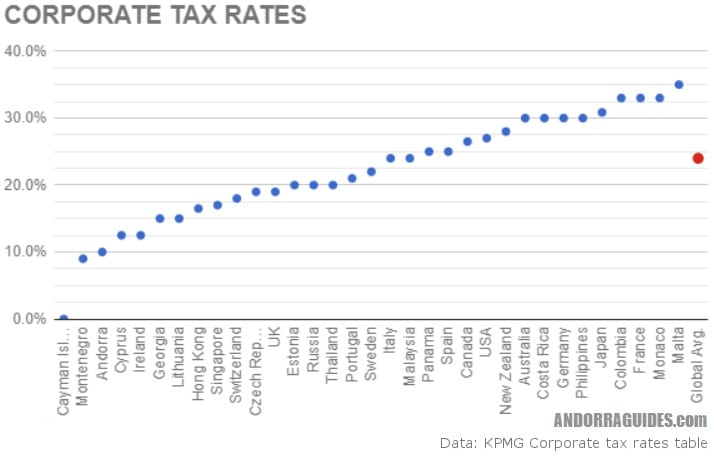

The nominal corporate tax rate on profits in Andorra is 10%. Though a special effective tax rate of 2% exists for certain types of companies such as holding companies investing in foreign companies (such as those owning property and intellectual property), this system is expected to see significant changes.

Corporate Withholding Taxes

The corporate withholding tax rate in Andorra, also known as a dividend withholding tax is 0%.

Royalties are taxed at a rate of 5%.

VAT; Indirect Tax

Andorra is known for its tax free shopping, but in reality most sales made within the country’s borders attract a 4.5% “I.G.I.“, or value-added tax.

This rate can be reduced to 0%, mostly for non-profits, education and medical care. 1% on foodstuffs (outside of alcohol), books, newspapers and magazines, and 2.5% on tourism operators and art.

An increased rate of 9.5% is applied to banking and financial services.

Capital Gains Tax

The nominal rate of capital gains tax in Andorra is 10%. There are however, some exceptions:

- If you own less than 25% of the share capital in an entity, you are not liable for capital gains tax.

- This is especially interesting for traders of publicly listed companies (please note: options, commodities and other investments are not covered by this exemption).

- Any asset held for more than 10 years is exempt from capital gains tax.

Capital gains tax in Andorra applies to investments worldwide. Where tax at or above the Andorran rate of 10% has already been paid on this investment abroad, it is not chargeable locally under double-taxation law.

Please note capital gains tax on real estate in Andorra is different again, which we cover below.

Tax on Real Estate

Real estate in Andorra is not subject to inheritance or transfer taxes, however owners are liable for both purchase taxes and capital gains tax on sales before 13 years of ownership.

Tax on the Purchase of Andorran Property

When buying property in Andorra, you should expect to pay two different types of tax:

- Fixed tax: 1.5% of the sale price paid to the comu (local government)

- Impost de Transmissions Patrimonials: 2.5% of the sale price paid to the Andorran Government

Tax on the Sale of Andorran Property (Capital Gains Tax)

Selling taxes are much more variable.

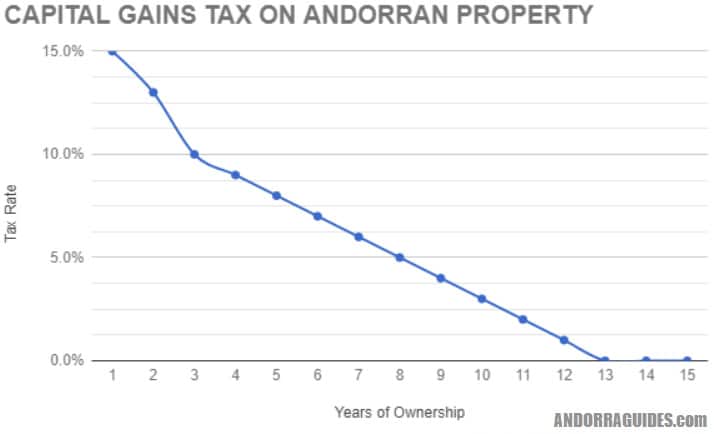

Andorran property has a capital gains tax between 0% and 15%, how much you pay depends on how long the property was held:

- 1 year: 15%

- 2 years: 13%

- 3 years: 10%

- 4 years: 9%

- 5 years: 8%

- 6 years: 7%

- 7 years: 6%

- 8 years: 5%

- 9 years: 4%

- 10 years: 3%

- 11 years: 2%

- 12 years: 1%

- 13 years or more: 0%

Double Taxation Agreements

Since the radical change in Andorra’s tax laws to meet international obligations and avoid being blacklisted as a tax haven, the government has been negotiating on double taxation agreements with countries around the world.

To date, the following countries have double taxation agreements with Andorra currently or will do shortly:

- France: Effective from July 1, 2015.

- Liechtenstein: Effective from November 21, 2016.

- Luxembourg: Effective from March 7, 2016.

- Malta: Signed September 20, 2016.

- Portugal: Effective from April 23, 2017.

- Spain: Effective August 1, 2017.

- United Arab Emirates: Effective August 1, 2017.

Andorra has been in negotiations with Belgium, Czech Republic and The Netherlands, and has expressed intentions to negotiate with Estonia, Latvia and Lithuania.

Andorra’s Tax System

While Andorra’s tax laws continue to evolve, the system remains straightforward enough to negotiate without too much headache.

Whether your plan is to incorporate or live in Andorra, you will be treated to some of the lowest tax rates in the developed, compliant world.

For more tax information in Andorra, please review the other articles available on this topic, in our Andorra Tax section.